Checkout Integration

Version: 4.5.2

Released: 2022/10/10

Introduction#

This document describes the Checkout integration procedures between

Checkout service and the website for e-commerce merchants.

To make your integration easier, please download collection and try it

out:

Postman Collection

General Information#

Checkout service is a fast and easy way to create a secure payment page. It allows collecting and submitting payments and sending them for processing.

To use the Checkout service on the site you have to perform integration. Checkout integration provides a set of APIs that allow customizing payment processing for the business. These protocols implement acquiring payments (purchases) using specific API interaction with the merchant websites.

The API requires request data as json string data and responds also with json string data.

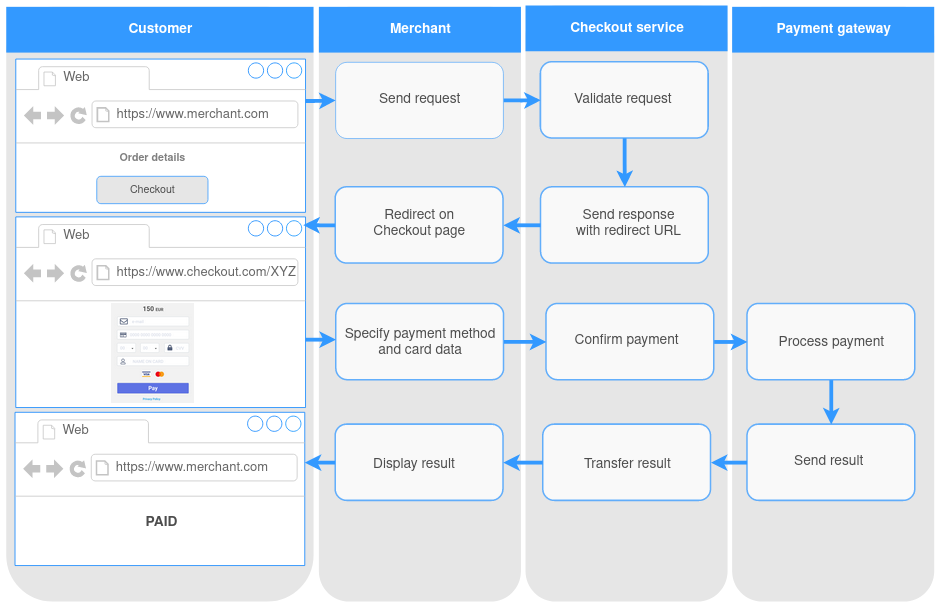

Checkout process#

Checkout payment flow is shown below.

When a Customer wants to make a purchase on your site the following

happens:

When a Customer wants to make a purchase on your site the following

happens:

- Customer places an order and initiates payment on the site.

- Site confirms the order and sends the payment processing request to the Checkout system with information about the order, payment and hash.

- Checkout system validates the request and sends to the site the response with the redirect link.

- The site redirects the Customer on the Checkout page by redirect link.

- Customer selects the payment method, enters the payment data and confirms the payment. The payment method will be specifying automatically If only one method is available.

- The payment processes at Payment Gateway.

- Payment Gateway sends a callback to the site with the payment result.

- The payment result is shown to the Customer.

The payment could be declined in case of invalid data detection.

Checkout page description#

Checkout page is shown to the Customer after a payment initiation. There are the fields to enter the payment data.

Fields and Validation#

The list of the fields on the Checkout page depends on the request parameters and the specified payment method.

Your customers will not see the fields if the acquirer does not need the information that is transmitted in them. For example, if an alternative payment method is specified, the card data is not displayed on the Checkout page.

As well, pay attention to the conditional fields such as e-mail or billing address. If the e-mail and billing address (data object) parameters are specified in the request, the Checkout page will not contain them.

Additional fields can also be displayed if a payment method is selected that requests additional data from the Customer.

The Checkout page has the fields validation. In case of the invalid data the error message will be shown and the field will be highlighted.

The list of the general fields and possible errors on the Checkout page is below:

| Fields | Type | Limitations | Error |

|---|---|---|---|

Card number |

Integral | Lun algorithm, length 14-19 numbers | Invalid card number |

Expirу Date |

Date | 2-2 numbers (in the format mm-yy), after today's date |

The expiration date of card is expired and not valid. |

Security code |

Integral | Up to 4 characters | Invalid security code |

Name on card |

String | Up to 22 characters (min - 2 characters) |

The name on card field must have at least 2 characters |

Country |

List | 2-letters code | Country is required. Please enter a valid Country |

State/Region |

String List - for USA, Canada, Australia, Japan, India |

||

City |

String | Up to 32 characters | City is required. Please enter a valid City |

Address line |

String | Up to 32 characters | Address line is required. Please enter a valid Address line |

Zip code |

String | Up to 32 characters | Zip code is required. Please enter a valid Zip code |

Phone number |

String | Up to 32 characters | Phone number is required. Please enter a valid Phone number |

Pre-routing#

To make payment method choice easier for the Customer, pre-routing is provided on the Checkout.

The functionality allows you to set up matches in the admin panel via the Custom routing module, which will determine the list of payment methods suitable for the current payment.

This way, you can restrict your Customers from randomly choosing a payment method that is not available in their region, for example. This will help you to increase the number of successful payments and reduce the risk of declined transactions.

Note that if the Authentication request contains a list of the payment

methods in the methods array, then the pre-routing

configurations will be ignored.

Card data tokenization#

For regular customers, we have made the payment page even more convenient and simple.

You can save the customer's card data so that they can reuse it for future payments.

To do this, you need to send the req_token = true parameter

in the Authentication request. And then, in the callback, you will

receive a card token.

Use the token when sending the next Authentication request and your client will see anonymized card details on the payment form, which will greatly simplify the payment process.

Web information#

Checkout service gathers information about browser, which the Customer uses.

When the Customer is on the Checkout page, the service gets the data about the Customer's OS, browser, and browser language. That information is sent to the acquirer in some cases.

iFrame option#

You can use iFrame option to show Checkout page on your domain. All you need is just to past in the code redirect url received in the response to the Authentication request.

Please follow the example:

<iframe src=redirect_url height="600" width="300"></iframe>Note that screen size can be adjusted according to your requirements.

Important: cross-domain requests are prohibited by security policy of our service.

Page Customization#

The administration service provides the ability to stylize the Checkout page in accordance with the preferences of the merchant. The action is available for the authorized users only. To customize the payment page you need:

- Click the “Configuration → Branding” item on the menu bar. The settings are displayed in the work area.

- Select a page template to make changes.

- Change the settings:

- login icon selection;

- color selection for the following items:

- heading;

- background;

- buttons;

- Click the “Submit” button to apply the settings. The selected settings will be displayed to the Customers on the Checkout page.

Authentication request parameters#

The merchant submits an authorization request and as a result of

successful response receives the redirect_url - link on the

Checkout page.

/api/v1/sessionThe authentication performs when the payment is initiated. INFO: You need to create an authentication request to start checkout process for the Customers. As a result of the authentication request you will receive the following:

- An authentication session is created with a unique identifier (Session ID). The session expires after one hour.

- A link is generated to redirect to the Checkout page: one link

corresponds to one payment. The link becomes invalid after a

successful payment. The authentication request parameters are

below.

If DMS-mode (two-stages payment) is available, after successful authentication it is necessary to capture. The capture would be performed automatically according to the settings or you can do it manually in the admin portal.

Request Parameters#

| Parameter | Type | Mandatory, Limitations | Description |

|---|---|---|---|

merchant_key |

String | Required | Key for Merchant identification Example: xxxxx-xxxxx-xxxxx |

operation |

String | Required | Defines a payment transaction Example: purchase |

methods |

Array | Optional | An array of payment methods. Limits the available methods on

the Checkout page (the list of the possible values in the

Payment methods section). In the case of parameter absence,

the pre-routing rules are applied. If pre-routing rules are

not configured, all available payment methods are

displayed. Example: card, paypal, googlepay |

success_url |

String | Required Valid URL max: 1024 |

URL to redirect the Customer in case of the successful

payment Example: https://example.com/success |

cancel_url |

String | Optional Valid URL min: 0 max: 1024 |

URL to return Customer in case of a payment cancellation

(“Close” button on the Checkout

page) Example: https://example.com/cancel |

url_target |

String | Optional Possible values: _blank,

_self, _parent, _top

or custom iframe name.Find the result of applying the values in the HTML standard description (Browsing context names) |

Name of, or keyword for a browsing context where Customer

should be returned according to HTML

specification. Example: _parent |

req_token |

Boolean | Optional default - false |

Special attribute pointing for further tokenization If the card_token is specified,

req_token will be

ignored.Example: false |

card_token |

Array of Strings | Optional String 64 characters |

Credit card token value Example: f5d6a0ab6fcfb6487a39e2256e50fff3c95aaa97 |

recurring_init |

Boolean | Optional default - false |

Initialization of the transaction with possible following

recurring Example: true |

schedule_id |

String | Optional It s available when recurring_init = true |

Schedule ID for recurring

payments Example: 57fddecf-17b9-4d38-9320-a670f0c29ec0 |

hash |

String | Required | Special signature to validate your request to Payment

Platform Addition in Signature

section. Example: Must be SHA1 of MD5 encoded string (uppercased): order_number + order_amount + order_currency + order_description + password |

| order | Object | Required | Information about an order |

number |

String | Required Not blank max: 255 [a-zA-Z0-9-] |

Order ID Example: order-1234 |

amount |

Float | Required Not blank Greater then 0 [0-9] max: 255 |

Product price. Format: XX.XX. Pay attention that amount format depends on currency exponent. If exponent = 0, then amount is integer (without decimals). It used for currencies: CLP, VND, ISK, UGX, KRW, JPY. If exponent = 3, then format: xx.xxx (with 3 decimals). It used for currencies: BHD, JOD, KWD, OMR, TND. Example: 0.19 |

currency |

String | Required Not blank 3 characters [A-Z] ISO 4217 |

Currency Example: USD |

description |

String | Required min: 2 max: 1024 [a-zA-Z0-9!"#$%&'()*+,./:;&@] |

Product name Example: Very important gift - # 9 |

| customer | Object | Required | Customer's information |

name |

String | Required min: 2 max: 32 Latin basic [a-zA-Z] |

Customer's name Example: John Doe |

email |

String | Conditional email format |

Customer's email address Condition: If the parameter is NOT

specified in the request, then it will be displayed on the

Checkout page (if a payment method needs) - the "E-mail"

field Example: example@mail.com |

| billing_address | Object | Conditional | Billing address information. Condition: If the object or some object's parameters are NOT specified in the request, then it will be displayed on the Checkout page (if a payment method needs) |

country |

String | Conditional 2 characters (alpha-2 code) ISO 3166-1 |

Billing country Example: US |

state |

String | Optional min: 2 max: 32 [a-zA-Z] It is 2-letters code for USA, Canada, Australia, Japan, India |

Billing state address Example: CA |

city |

String | Conditional min: 2 max: 32 [a-zA-Z] |

Billing city Example: Los Angeles |

address |

String | Conditional min: 2 max: 32 [a-zA-Z0-9] |

Billing address Example: Moor Building 35274 |

zip |

String | Conditional min: 2 max: 10 [a-zA-Z0-9] |

Billing zip code Example: 123456, MK77 |

phone |

String | Conditional min: 0 max: 32 [0-9+()-] |

Customer phone number Example: 347771112233 |

| parameters | Object | Extra-parameters required for specific payment

method Example: "parameters": { "payment_method": { "param1":"val1", "param2":"val2" } }

|

Example Request

Authentication (OK)

curl --location -g --request POST '{{CHECKOUT_HOST}}/api/v1/session' \--data-raw '{ "merchant_key": "xxxxx-xxxxx-xxxxx", "operation": "purchase", "methods": [ "card" ], "order": { "number": "order-1234", "amount": "0.19", "currency": "USD", "description": "Important gift" }, "cancel_url": "https://example.com/cancel", "success_url": "https://example.com/success", "customer": { "name": "John Doe", "email": "test@gmail.com" }, "billing_address": { "country": "US", "state": "CA", "city": "Los Angeles", "address": "Moor Building 35274", "zip": "123456", "phone": "347771112233" }, "hash": "{{session_hash}}",}'Authentication (with card token)

curl --location -g --request POST '{{CHECKOUT_HOST}}/api/v1/session' \--data-raw '{ "merchant_key": "1c568e26-c997-11e9-8be4-0242ac12000f", "operation": "purchase", "methods": [ "card", "paypal", "netbanking-upi" ], "order": { "number": "{{order_number}}", "amount": "{{order_amount}}", "currency": "{{order_currency}}", "description": "{{order_description}}" }, "cancel_url": "https://example.com/cancel", "success_url": "https://example.com/success", "customer": { "name": "John Doe", "email": "success@gmail.com" }, "billing_address": { "country": "US", "state": "California", "city": "Los Angeles", "address": "Moor Building 35274 State ST Fremont. U.S.A", "zip": "94538", "phone": "347771112233" }, "card_token": [ "f5d6a0ab6fcfb6487a39e2256e50fff3c95aaa97075ee5e539bb662fceff4dc1" ], "req_token": true, "hash": "{{session_hash}}"}'Authentication (with recurring schedule)

curl --location -g --request POST '{{CHECKOUT_HOST}}/api/v1/session' \--data-raw '{ "merchant_key": "xxxxx-xxxxx-xxxxx", "operation": "purchase", "methods": [ "card" ], "order": { "number": "order-1234", "amount": "0.19", "currency": "USD", "description": "Important gift" }, "cancel_url": "https://example.com/cancel", "success_url": "https://example.com/success", "customer": { "name": "John Doe", "email": "test@gmail.com" }, "billing_address": { "country": "US", "state": "CA", "city": "Los Angeles", "address": "Moor Building 35274", "zip": "123456", "phone": "347771112233" }, "recurring_init": true, "schedule_id": "57fddecf-17b9-4d38-9320-a670f0c29ec0", "hash": "{{session_hash}}"}'Example Response (OK)

{ "redirect_url": "{{CHECKOUT_HOST}/auth/ZXlKMGVYQWlPaUpLVjFRaUxDSmhiR2NpT2lKU1V6STFOaUo5LmV5SnBZWFFpT2pFMU9UWXhPRFl6T0Rnc0ltcDBhU0k2SWpGbE5qTTNObVZoTFdRek1HUXRNVEZsWVMxaE16QXlMVEF5TkRKak1HRTRNekF4TWlJc0ltVjRjQ0k2TVRVNU5qRTRPVGs0T0gwLm9CMmVhdlRtTU5DMXFTajlDVFlqQ0dOMDlHdUs1NXRkQTVpWFR3d2F2cWR0cEpEU2NRWWFaT3Z5dmJSVjJUSFNUVlFlS0NUX3pRdFNycDlKS1M4X0pqUzRMclM5MnUyNXRfSHNGa1FUQ0VOdGtadHQtaGxONERYdVhkLTU5cEhKLUN1RXBqSmZ4UDZEQXhFaVAxWEpRZDlyQldNa1RQVDdGZm1ac0g4LTM5YnV6LTI3MWxKMndkekdvSGJYa0NKVnNTNFJldGxrbno2U3dGd3ZFMW5KNDhwYTBGMDNLWjBpNnhpRFVPR3p2U0ZKdGZfMndDTTdzTTdsemc1TlBmSDl0Q0RKQmZEaG1hUmJCRmR6RlZMZlJncG5tMzB3VWpTMGMxbmt6SkkxOGJTd2Z6Z0hfZFpnc1cyUFhCM2ZLdG9pWDJXeFRsQzlxR204QTRYVm9EQy1mOWxvRHlMd0F5eV9xY3JrWmNuQTJVSjk5Zl91c0cwODZKUlBTT0I4VHVRZndSTzUxSEN2bEU2TXdFYzVYRmtnYjBleEZRcXdpNGE4S2RlWV9HX3ZQam42bnpZODdtVzFINlpQMjJ0dzVzazYtUENMeHdvNXctUmFBWC1mYVVhcEVHTzFLZkVHbndaQWZBZVNyc3U4MV9XQUFJMlN5RUxGWi1IU1lXMUZLWFgybzNNeF93Ty1DS3FLTWZsUTV1cGc2eDAybzhsbFhoeGJlVmVIOWlkMHgzYldRWE9vWk5hWm1MeVpJMmJsT2dtVDV0cHR4NHNQNDNqT0NtYW1sdkxyUkZvQmxCNTJ4V0RUQTBZQnhBLW5meUxCRHRJN0dPaVRWQjJ5cWd1Z1lBdGRfbWFQN2x2YTJpbVJWaHhxT0R5SlRiZThxcDdhWkw4bkJvTHZocnZDOHlv"}Authentication request possible errors#

Parameter Values Validation#

Checkout service validates the request parameters and sends the error responses in case of an invalid data detection.

Example Request - Validation (bad)

curl --location -g --request POST '{{CHECKOUT_HOST}}/api/v1/session' \--data-raw '{ "merchant_key":"xxxxx-xxxxx-xxxxx", "operation":"credit", "methods":[ "" ], "order":{ "number":"", "amount": "1.2", "currency":"Dollar", "description":"" }, "cancel_url":"1.com", "success_url":"", "customer":{ "name":"John Doe", "email":"example@mail.com" }, "recurring_init": "true", "hash":"728d13b95cf2b6b3ee04b20dc2fc9889ffff1cf4"}'Example Response - 400 Bad Request

{ "error_code": 0, "error_message": "Request data is invalid.", "errors": [ { "error_code": 100000, "error_message": "operation: The value you selected is not a valid choice." }, { "error_code": 100000, "error_message": "methods: This value should not be blank." }, { "error_code": 100000, "error_message": "order.number: This value should not be blank." }, { "error_code": 100000, "error_message": "order.amount: This value should be greater than 0." }, { "error_code": 100000, "error_message": "order.currency: This value is not valid." }, { "error_code": 100000, "error_message": "order.description: This value should not be blank." }, { "error_code": 100000, "error_message": "cancel_url: This value is not a valid URL." }, { "error_code": 100000, "error_message": "success_url: This value should not be blank." } ]}Hash Validation#

The Checkout service always performs hash validation.

The request will be rejected if the hash value is invalid.

Example Request - Hash Validation

curl --location -g --request POST '{{CHECKOUT_HOST}}/api/v1/session' \--data-raw '{ "merchant_key":"xxxxx-xxxxx-xxxxx", "operation":"purchase", "methods":[ "card" ], "order":{ "number":"order-1234", "amount": "0.19", "currency":"USD", "description":"Important gift" }, "cancel_url":"https://example.com/cancel", "success_url":"https://example.com/success", "customer":{ "name":"John Doe" }, "hash":"wrong hash"}'Example Response - Hash error

{ "error_code": 0, "error_message": "Request data is invalid.", "errors": [ { "error_code": 100000, "error_message": "hash: Hash is not valid." } ]}Callback Notification#

Checkout service sends the callback on the merchant

notification_URL as a result of an operation.

You can receive the callback for the next operation types:

- SALE

- 3DS

- REDIRECT

- REFUND

- RECURRING

- CHARGEBACK

List of Possible Transaction Statuses#

The possible statuses are listed below:

| Status | Operation type | Description |

|---|---|---|

| SUCCESS | sale, 3ds, redirect, refund, recurring, chargeback | Transaction is successfully completed in Payment Platform |

| FAIL | sale, refund, recurring | Transaction has the errors and is not validated by Payment Platform |

| WAITING | sale, refund, recurring | Transaction is being processed by Payment Platform |

⚠️ Pay attention

that successful transaction does not mean successful final status for payment.

For example:

Payment is successfully completed if transaction hasstatus= success andtype= sale. Payment is not completed if transaction hasstatus= success andtype= redirect.

Callback parameters#

Callback includes the following data:

| Parameter | Type | Mandatory, Limitations | Description |

|---|---|---|---|

id |

String | Required | Transaction ID Example: dc66cdd8-d702-11ea-9a2f-0242c0a87002 |

order_number |

String | Required Up to 255 characters | Order ID Example: order-1234 |

order_amount |

Float | Required Format: XX.XX, without leading zeroes | Product price Example: 0.19 |

order_currency |

String | Required Up to 3 characters | Currency (3-characters code) Example: USD |

order_description |

String | Required Up to 1024 characters | Product description Example: Important gift |

type |

String | Required Up to 36 characters | Operation type: sale, 3ds, redirect, refund, chargeback

Example: sale |

status |

String | Required Up to 20 characters | Transaction status: success, fail, waiting

Example: success |

reason |

String | Optional Up to 1024 characters | Decline or error reason (for "sale" and "refund" operation

types only). It displays only if the transaction has FAIL

status Example: The operation was rejected. Please contact the site support |

rrn |

String | Optional | Retrieval Reference Number value from the acquirer system |

approval_code |

String | Optional | Approval code value from the acquirer system |

card |

String | Optional Format: ХХХХХХ****ХХХХ |

Card number mask Example: 411111******1111 |

card_expiration_date |

String | Optional | Card expiration date Example: 12/2022 |

card_token |

String | Optional | Card token. It is available if the parameter

req_token was

enabledExample: VjFRaUxDSmhiR2NpT2lKU1V6STFO |

customer_name |

String | Optional | Customer's first and last name Example: John Rickher |

customer_email |

String | Optional Format: example@mail.com | Customer's email address Example: fdfd@dfsds.ds |

customer_country |

String | Optional Up to 3 characters | Customer's country Example: US |

customer_state |

String | Optional Up to 32 characters | Customer's state Example: California |

customer_city |

String | Optional | Customer's city Example: Los Angeles |

customer_address |

String | Optional Up to 32 characters | Customer's address Example: 123 Sample Street |

customer_ip |

String | Required | Customer's IP Example: 255.41.45.57 |

date |

Date | Optional Format: YYYY-MM-DD hh:mm:ss | Transaction date Example: 2020-08-05 07:41:10 |

recurring_init_trans_id |

String | Optional | Reference to the first transaction that initializes the

recurring (provided if recurring was

initialized) Example: dc66cdd8-d702-11ea-9a2f-0242c0a87099 |

recurring_token |

String | Optional | Recurring token (provided if recurring was

initialized) Example: e5f60b35485e |

schedule_id |

String | Optional | It is available if schedule is used for recurring sale |

hash |

String | Required | Special signature, used to validate callback Addition in

Signature section. Example: Must be SHA1 of MD5 encoded string (uppercased): payment_public_id + order.number + order.amount + order.currency + order.description + merchant.pass |

Examples#

Callback examples

Merchant successful sale callback

{ id=f0a51dfa-fc43-11ec-8128-0242ac120004 order_number=order-1234 order_amount=3.01 order_currency=USD order_description=bloodline type=sale status=success card=411111****1111 card_expiration_date=12/2022 schedule_id=4e46866c-f84b-11ec-8b4c-0242ac120007 recurring_init_trans_id=f0a51dfa-fc43-11ec-8128-0242ac120004 recurring_token=f0e24964-fc43-11ec-a7e0-0242ac120004 date=2022-07-05 09:22:09 hash=6d8d440e25bdfc5288616ce567496948d2562852 customer_name=D D customer_email=success@gmail.com customer_country=US customer_state=California customer_city=Los Angeles customer_address=Moor Building 35274 State ST Fremont. U.S.A customer_ip=10.10.10.2}Merchant successful refund callback

{ id=f0a51dfa-fc43-11ec-8128-0242ac120004 order_number=order-1234 order_amount=3.01 order_currency=USD order_description=bloodline type=refund status=success card=411111****1111 card_expiration_date=12/2022 schedule_id=4e46866c-f84b-11ec-8b4c-0242ac120007 date=2022-07-05 09:28:01 hash=6d8d440e25bdfc5288616ce567496948d2562852 customer_name=D D customer_email=success@gmail.com customer_country=US customer_state=California customer_city=Los Angeles customer_address=Moor Building 35274 State ST Fremont. U.S.A customer_ip=10.10.10.2}Merchant unsuccessful sale callback

{ id=1f34f446-fc45-11ec-a50f-0242ac120004 order_number=order-1234 order_amount=3.01 order_currency=USD order_description=bloodline type=sale status=fail card=411111****1111 card_expiration_date=12/2022 reason=Declined by processing. date=2022-07-05 09:30:35 hash=7f15d178e9b2c8507dea57f8ed1efddb9573fa6b customer_name=D D customer_email=success@gmail.com customer_country=US customer_state=California customer_city=Los Angeles customer_address=Moor Building 35274 State ST Fremont. U.S.A customer_ip=10.10.10.2}Merchant unsuccessful refund callback

{ id=ba290c62-fc45-11ec-9e91-0242ac120004 order_number=order-1234 order_amount=3.01 order_currency=USD order_description=bloodline type=refund status=fail card=411111****1111 card_expiration_date=12/2022 reason=Declined by processing. schedule_id=4e46866c-f84b-11ec-8b4c-0242ac120007 recurring_init_trans_id=ba290c62-fc45-11ec-9e91-0242ac120004 recurring_token=ba51844e-fc45-11ec-932c-0242ac120004 date=2022-07-05 09:38:00 hash=bcd78ff8b8e6b75aa1743910641217be6edc3a43 customer_name=D D customer_email=success@gmail.com customer_country=US customer_state=California customer_city=Los Angeles customer_address=Moor Building 35274 State ST Fremont. U.S.A customer_ip=10.10.10.2}Recurring#

Recurring payments are commonly used to create new transactions based on already stored cardholder information from previous operations. This request is sent by POST.

RECURRING request

/api/v1/payment/reсurringRequest Parameters#

| Parameter | Type | Mandatory, Limitations | Description |

|---|---|---|---|

merchant_key |

String | Required | Key for Merchant

identification Example: xxxxx-xxxxx-xxxxx |

recurring_init_trans_id |

String | Required | Transaction ID of the primary transaction in

the Payment Platform Example: dc66cdd8-d702-11ea-9a2f-0242c0a87002 |

recurring_token |

String | Required | Recurring token Example: 9a2f-0242c0a87002 |

schedule_id |

String | Optional | Schedule ID for recurring payments |

hash |

String | Required | Special signature to validate your request to

Payment Platform Addition in Signature

section Example: Must be SHA1 of MD5 encoded string (uppercased): recurring_init_trans_id + recurring_token + order.number + order.amount + order.description + merchant_pass |

| order | Object | ||

number |

String | Required Not blank max: 255 [a-zA-Z0-9-] |

Order ID Example: order-1234 |

amount |

Float | Required Not blank Greater then 0 0-9 max: 255 |

Product price. Format: XX.XX Pay attention that amount format depends on currency exponent. If exponent = 0, then amount is integer (without decimals). It used for currencies: CLP, VND, ISK, UGX, KRW, JPY. If exponent = 3, then format: xx.xxx (with 3 decimals). It used for currencies: BHD, JOD, KWD, OMR, TND. Example: 0.19 |

description |

String | Required min: 2 max: 1024 [a-zA-Z0-9!"#$%&'()*+,./:;&@] |

Product name Example: Very important gift - # 9 |

Response Parameters#

| Parameter | Type | Mandatory, Limitations | Description |

|---|---|---|---|

merchant_key |

String | Required | Transaction status Example: PREPARE, SETTLED, PENDING, 3DS, REDIRECT, DECLINE, REFUND, REVERSAL, CHARGEBACK |

reason |

String | Optional | Decline reason translation for unsuccessful payment. It displays only if the transaction is unsuccessful Example: The operation was rejected. Please contact the site support |

payment_id |

String | Required Up to 255 characters |

Transaction ID (public) Example: dc66cdd8-d702-11ea-9a2f-0242c0a87002 |

date |

String | Required Format: YYYY-MM-DD hh:mm:ss |

Transaction date Example: 2020-08-05 07:41:10 |

schedule_id |

String | Optional | Schedule ID for recurring payments |

| order | Object | ||

number |

String | Required max: 255 |

Order ID Example: order-1234 |

amount |

String | Required Format: XX.XX |

Product price (currency will be defined by the first

payment) Example: 0.19 |

currency |

String | Required 3 characters |

Currency Example: USD |

description |

String | Required max: 1024 |

Product name Example: Very important gift - # 9 |

Example Request

Recurring (settled)

curl --location -g --request POST '{{CHECKOUT_HOST}}/api/v1/payment/reсurring' \--data-raw '{ "merchant_key":"xxxxx-xxxxx-xxxxx", "order":{ "number":"order-1234", "amount": "0.19", "description":"very important gift"}, "customer": { "name": "John Doe", "email": "success@gmail.com" }, "recurring_init_trans_id":"dc66cdd8-d702-11ea-9a2f-0242c0a87002", "recurring_token":"9a2f-0242c0a87002", "schedule_id":"57fddecf-17b9-4d38-9320-a670f0c29ec0", "hash":"{{session_hash}}"}'Recurring (declined)

curl --location -g --request POST '{{CHECKOUT_HOST}}/api/v1/payment/reсurring' \--data-raw '{ "payment_id": "1f34f446-fc45-11ec-a50f-0242ac120004", "date": "2022-07-05 09:30:34", "status": "decline", "reason": "Declined by processing.", "order": { "number": "order-1234", "amount": "3.01", "currency": "USD", "description": "bloodline" }, "customer": { "name": "John Doe", "email": "success@gmail.com" }}'Example Response

Status Settled

{ "status": "settled", "payment_id": "dc66cdd8-d702-11ea-9a2f-0242c0a87002", "date": "2020-08-05 07:41:10", "schedule_id":"57fddecf-17b9-4d38-9320-a670f0c29ec0", "order": { "number": "order-1234", "amount": "0.19", "currency": "USD", "description": "very important gift" }}Status Declined

{ "status": "declined", "reason": "declined by processing", "payment_id": "dc66cdd8-d702-11ea-9a2f-0242c0a87002", "schedule_id":"57fddecf-17b9-4d38-9320-a670f0c29ec0", "date": "2020-08-05 07:41:10", "order": { "number": "order-1234", "amount": "0.19", "currency": "USD", "description": "very important gift" }}Get transaction status#

To get order status you can use GET_TRANS_STATUS request. Use payment

public_id from Payment Platform in the request.

GET_TRANS_STATUS request

/api/v1/payment/statusRequest Parameters#

| Parameter | Type | Mandatory, Limitations | Description |

|---|---|---|---|

merchant_key |

String | Required | Key for Merchant identification Example: xxxxx-xxxxx-xxxxx |

payment_id |

String | Required Up to 255 characters | Payment ID (public) Example: dc66cdd8-d702-11ea-9a2f-0242c0a87002 |

hash |

String | Required | Special signature to validate your request to Payment

Platform Addition in Signature

section. Example: Must be SHA1 of MD5 encoded string (uppercased): payment_id + merchant_pass |

Response Parameters#

| Parameter | Type | Mandatory, Limitations | Description |

|---|---|---|---|

payment_id |

String | Required Up to 255 characters | Payment ID (public) Example: dc66cdd8-d702-11ea-9a2f-0242c0a87002 |

date |

String | Required Format: YYYY-MM-DD hh:mm:ss | Transaction date Example: 2020-08-05 07:41:10 |

status |

String | Required | Payment status: prepare, settled, pending, 3ds, redirect,

decline, refund, reversal,

chargeback Example: settled |

reason |

String | Optional | Decline reason translation for unsuccessful payment. It

displays only if the transaction is

unsuccessful Example: The operation was rejected. Please contact the site support |

| order | Object | ||

number |

String | Required Up to 255 characters | Order ID Example: order-1234 |

amount |

String | Required Format: XX.XX | Product price (currency will be defined by the first

payment) Example: 0.19 |

currency |

String | Required Up to 3 characters | Currency Example: USD |

description |

String | Required Up to 1024 characters | Product name Example: Very important gift |

| customer | Object | ||

name |

String | Required | Customer's name Example: John Doe |

Example Request

GET_TRANS_STATUS request (setteled)

curl --location -g --request POST '{{CHECKOUT_HOST}}/api/v1/payment/status' \--data-raw '{ "merchant_key":"xxxxx-xxxxx-xxxxx", "payment_id":"63c781cc-de3d-11eb-a1f1-0242ac130006", "hash":"{{operation_hash}}"}'GET_TRANS_STATUS request (declined)

curl --location -g --request POST '{{CHECKOUT_HOST}}/api/v1/payment/status' \--data-raw '{ "merchant_key":"xxxxx-xxxxx-xxxxx", "payment_id":"03e46e96-de42-11eb-aea7-0242ac140002", "hash":"{{operation_hash}}"}'Example Response

Status Settled

{ "payment_id": "24f7401c-fc47-11ec-8d07-0242ac120015", "date": "2022-07-05 09:45:03", "status": "settled", "order": { "number": "f0a51dfa-fc43-11ec-8128-0242ac120004-1", "amount": "3.01", "currency": "USD", "description": "bloodline" }, "customer": { "name": "John Doe", "email": "success@gmail.com" }}Status Declined

{ "payment_id": "03e46e96-de42-11eb-aea7-0242ac140002", "date": "2021-07-06 10:07:47", "status": "decline", "reason": "Declined by processing", "order": { "number": "order-1234", "amount": "0.19", "currency": "USD", "description": "Important gift" }, "customer": { "name": "John Doe", "email": "test@mail.com" }}Refund#

To make refund you can use Refund request. Use payment public ID from Payment Platform in the request.

Refund request

/api/v1/payment/refundRequest Parameters#

| Parameter | Type | Mandatory, Limitations | Description |

|---|---|---|---|

merchant_key |

String | Required | Key for Merchant identification Example: xxxxx-xxxxx-xxxxx |

payment_id |

String | Required Up to 255 characters | Transaction ID (public) Example: dc66cdd8-d702-11ea-9a2f-0242c0a87002 |

amount |

String | Optional Format: XX.XX, without leading zeroes | Amount to refund. It is required for particular refund. If

amount is not specified the full order amount is settled by

default. Example: 0.19 |

hash |

String | Required | Special signature to validate your request to Payment

Platform Addition in Signature section. Example: Must be SHA1 of MD5 encoded string (uppercased): payment.id + amount + merchant.pass |

Response Parameters#

| Parameter | Type | Mandatory, Limitations | Description |

|---|---|---|---|

payment_id |

String | Required Up to 255 characters | Transaction ID (public) Example: dc66cdd8-d702-11ea-9a2f-0242c0a87002 |

result |

String | Required | Refund request result Example: accepted |

Example Request

curl --location -g --request POST '{{CHECKOUT_HOST}}/api/v1/payment/refund' \--data-raw '{ "merchant_key":"xxxxx-xxxxx-xxxxx", "payment_id":"63c781cc-de3d-11eb-a1f1-0242ac130006", "amount":"0.10", "hash":"{{operation_hash}}"}'Example Response - Refund request accepted

Body

{ "payment_id": "63c781cc-de3d-11eb-a1f1-0242ac130006", "result": "accepted"}Signature#

Sign is signature rule used either to validate your requests to payment platform or to validate callback from payment platform to your system.

Authentication Signature#

It must be SHA1 of MD5 encoded string and calculated by the formula below:

*sha1(md5(strtoupper(id.order.amount.currency.description.PASSWORD)))

// Use the CryptoJSvar

Example for JS#

var to_md5 = order.number + order.amount + order.currency + order.description + merchant.pass;// Use the CryptoJS

var hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString());

var result = CryptoJS.enc.Hex.stringify(hash);

Get Transaction Status Signature#

It must be SHA1 of MD5 encoded string and calculated by the formula below:

hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString()); *sha1(md5(strtoupper))

// Use the CryptoJSvar

Example for JS#

var to_md5 = payment.id + merchant.pass;// Use the CryptoJS

var hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString());

var result = CryptoJS.enc.Hex.stringify(hash);

Refund Signature#

It must be SHA1 of MD5 encoded string and calculated by the formula below:

hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString()); *sha1(md5(strtoupper))

// Use the CryptoJSvar

Example for JS#

var to_md5 = payment.id + amount + merchant.pass;// Use the CryptoJS

var hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString());

var result = CryptoJS.enc.Hex.stringify(hash);

Recurring Signature#

It must be SHA1 of MD5 encoded string and calculated by the formula below:

*sha1(md5(strtoupper(recurring_init_trans_id.recurring_token.order_id.amount.description.merchant.pass)))

// Use the CryptoJSvar

Example for JS#

var to_md5 = recurring_init_trans_id + recurring_token + order.number + order.amount + order.description + merchant.pass;// Use the CryptoJS

var hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString());

var result = CryptoJS.enc.Hex.stringify(hash);

Callback Signature#

It must be SHA1 of MD5 encoded string and calculated by the formula below:

hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString()); *sha1(md5(strtoupper(payment_public_id.order_id.amount.currency.description.PASSWORD)))

Example for JS#

var to_md5 = payment_public_id + order.number + order.amount + order.currency + order.description + merchant.pass;// Use the CryptoJS

var hash = CryptoJS.SHA1(CryptoJS.MD5(to_md5.toUpperCase()).toString());

var result = CryptoJS.enc.Hex.stringify(hash);

Testing#

You can test your integration. To do the test you need to perform the

actions with the API using (in test mode). For instance, send the

request and receive the response with a link on the Checkout page.

To

mark your transactions as test in the system, you should use Merchant

Test Key as value of the merchant_key parameter. You can

contact your administrator to make sure that you have the necessary

settings to work with test transactions.

Use the following test data to emulate the different scenarios.

Scenario: SUCCESS payment

Card data:

Card number 4111 1111 1111 1111

Expiry Date 01/25

CVV2 any 3 digits

Result: customer is redirected to the "success_URL"

Scenario: FAILED payment (decline)

Card data:

Card number 4111 1111 1111 1111

Expiry Date 02/25

CVV2 any 3 digits

Result: customer gets an error message: Declined by processing.

Scenario: SUCCESS 3DS payment

Card data:

Card number 4111 1111 1111 1111

Expiry Date 05/25

CVV2 any 3 digits

Result: customer is redirected to the "success_URL" after 3DS verification

Scenario: FAILED 3DS paymentу

Card data:

Card number 4111 1111 1111 1111

Expiry Date 06/25

CVV2 any 3 digits

Result: customer gets unsuccessful sale after 3DS verification

Scenario: FAILED payment (Luhn algorithm)

Card data:

Card number 1111 2222 3333 4444

Expiry Date 01/25

CVV2 any 3 digits

Result: customer gets an error message: Bad Request. Brand of card does not support.

Payment methods#

You can choose the payment methods that you want to display on the

payment form.

Use methods array in the Authentication request and specify

the values that correspond to the payment methods.

As well, you can use the value of the payment method to add specific

parameters to the Authentification request for the

paramaters object. These parameters will be sent to the

acquirer to pass the necessary data for successful payment.

stcpay#

payment_method = stcpay

applepay#

payment_method = applepay

cybersource#

payment_method = cybersource